The Wolfe Wave pattern is a unique pattern that emerges within the sequence of price waves in the forex market. Consisting of five waves in the context of bullish or bearish trends, this pattern exhibits highly symmetrical characteristics. Although less commonly discussed, the Wolfe Wave pattern can be an effective trading strategy when applied correctly. Here is a comprehensive guide on the Wolfe Wave pattern and its trading approach:

Understanding the Wolfe Wave Pattern:

- Developed by Bill Wolfe, the Wolfe Wave pattern consists of five waves within bullish or bearish trends.

- This pattern is commonly found within uptrend or downtrend channel formations, although it can also occur during ranging conditions.

- The Wolfe Wave pattern adheres to specific rules that must be met to determine its validity.

Trading Strategy for Wolfe Wave:

- Pattern Identification: Determine whether the market is in a bullish or bearish trend and identify the corresponding Wolfe Wave pattern.

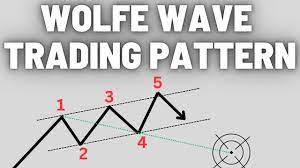

- Label Each Leg: Assign numbers 1 through 5 to each leg of the Wolfe Wave pattern.

- Draw Trend Lines: Draw trend lines connecting leg one to leg three, and leg two to leg four.

- Signal Confirmation: Confirm buy or sell entry signals when the price re-enters the channel after surpassing the trend lines.

- Set Stop Loss and Target Profit: Place stop loss orders just above swing highs (for sell trades) or below swing lows (for buy trades). Determine target profits by projecting trend lines 1-4 forward.

Example Trading Strategies:

- Bullish Wolfe Wave: Identify a bullish Wolfe Wave pattern, draw trend lines, and confirm a buy entry when the price re-enters the channel.

- Bearish Wolfe Wave: Identify a bearish Wolfe Wave pattern, draw trend lines, and confirm a sell entry when the price re-enters the channel.

- Utilize appropriate stop loss and target profit levels to protect positions and capture profits.

Integration with Other Indicators:

- The Wolfe Wave pattern can be combined with other indicators such as oscillators, Moving Averages, or trend indicators to enhance trading signal confirmation.

- Additional indicators can assist in identifying confirmation signs or divergences to validate signals arising from the Wolfe Wave pattern.

While the Wolfe Wave pattern may be less popular, it can be an effective trading strategy when applied correctly. Traders should understand the rules and characteristics of this pattern and employ proper risk management techniques. With careful application, the Wolfe Wave pattern can serve as a valuable addition to your trading repertoire.

.png)